How To Create a Competitive Analysis

This is one of the most frequently asked questions from prospects and resellers, yet I often find a company that does NOT have a competitive analysis (or it is seriously out of date). In addition, we can’t properly position a product and answer the question, “Why would I be a FOOL not to consider you?” without first understanding the strengths and weaknesses of the product–which is done within the competitive analysis. So, we have to make a competitive matrix.

I usually prefer using an intern to do this, since it is easily teachable, but it can be time-consuming. In fact, if you do not set a deadline and put your feet to the fire, you may take months getting it done (versus about 1 1/2 weeks (avg time)), plus a few tweaks.

The following are the detailed instructions I provide to interns (or anyone internally) to do the competitive analysis and create a competitive matrix. These steps are refined from creating over 200 different competitive analyses–if you can find a faster way, by all means, share it (but this is been optimized for speed and thoroughness).

We are using PROJECT MANAGEMENT as the example category – since it is one of the most competitive spaces with a lot of competitors and market segments–so anything else is easy. NOTE: Do NOT skip any of the steps (or it can take longer since we usually have to backtrack).

Creating a Competitive Analysis Matrix

Welcome to the positioning team. This is going to be FUN (actually, tedious, but we can have fun, knowing that the resultant information will be powerful and incredibly valuable). Thanks in advance for your help.

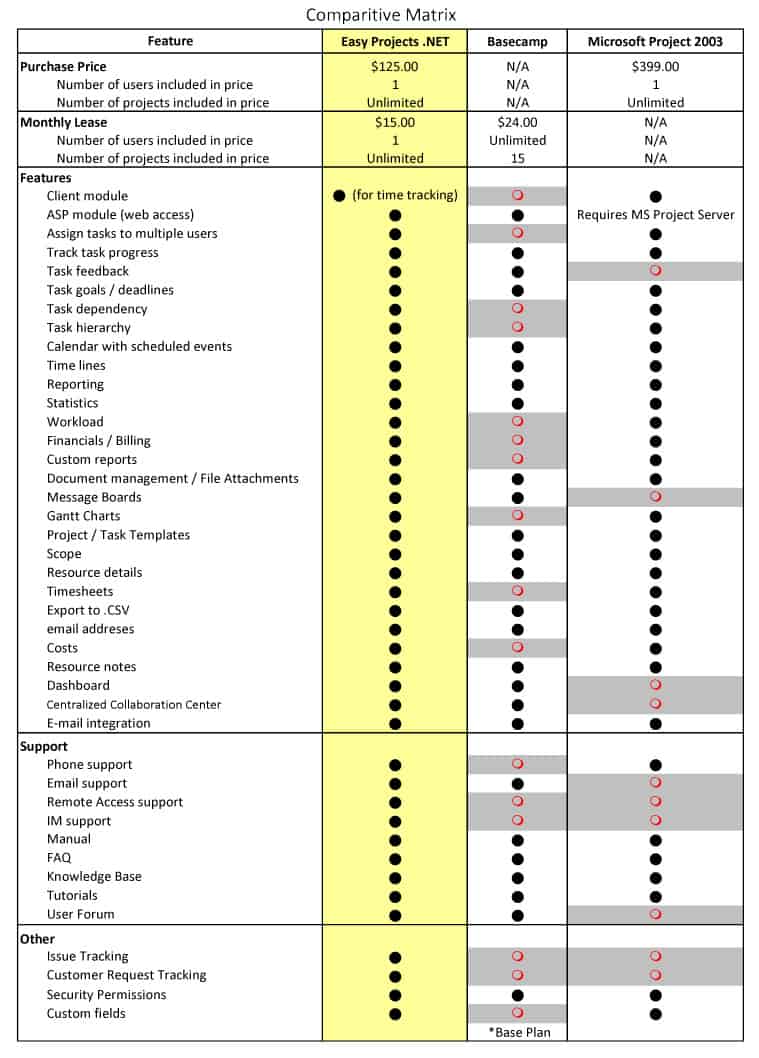

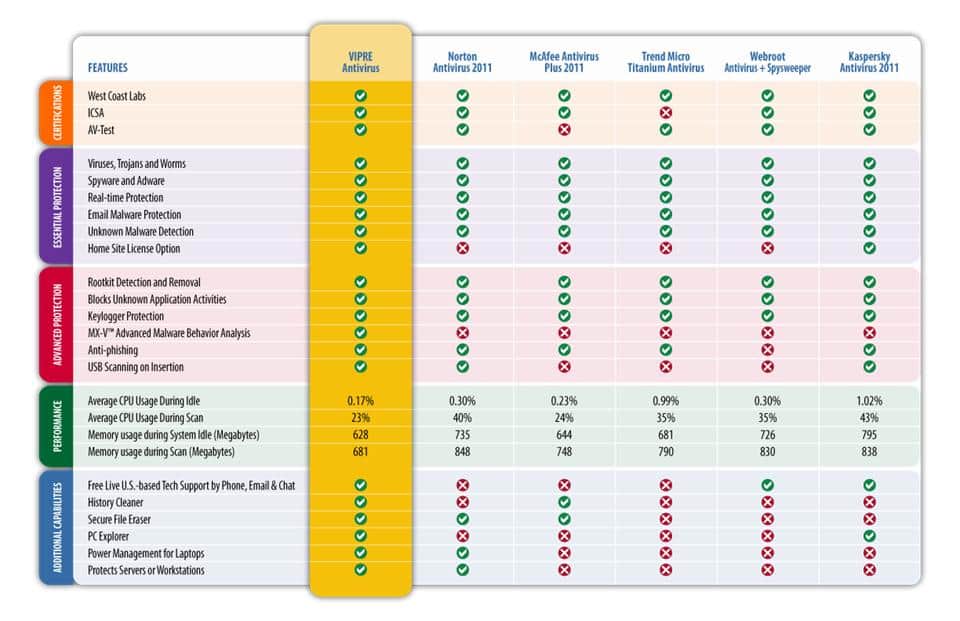

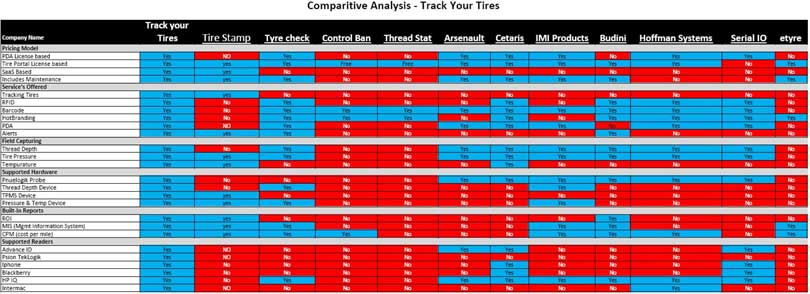

Attached are some sample competitive matrix samples. What we are really looking for are areas where we differ from the competition. We will use the project management category as the primary SAMPLE because it is VERY competitive with about 200 competitors. As such, it has a lot of examples, and it is also all the more important to differentiate our product. One of the ways is with a competitive matrix. Following is a process I recommend (this uses Project Management as an example):

PHASE I – Secondary Research

We always want to look for existing information about the competition and the market before we do all the manual leg work–especially since some categories have complete matrixes almost completed and all we have to do is add our product. It would be a pity to spend a week digging up all the information from websites, forums and documentation–only to discover a site that has the matrix completed (see the affiliate-software-review PDF). I would spend a few hours just looking for existing research before creating your own matrix–2 hours versus 20 hours of boring research!

- Determine the different “types” of project management software. We want to see if the market is split into segments–high-end needs, middle needs, or by the size of the company, etc. We do this so we can “de-position” an entire segment at once if we choose. For example, in Data Storage the market is split into software only, enterprise, Linux only, open-source, consumer and cloud-based. If someone is looking for cloud–we can eliminate all the segments at once (making our list of competitors much shorter. Back to project management, do we have features that put us in project management, a PPM or other areas? If so, we need to know that. A lot of times we can look at industry analyst reports (see Gartner report).

- Check out the industry Analyst. Gartner is a major industry analyst company (about 1 billion in revenues). They “position” different products as the leaders, etc. and also set up the categories. Type, “Magic Quadrant” into Google and you will see their positioning reports.

- Consider their Magic Quadrant, etc. This helps us see a macro view of the overall market and if it is divided by segments. We can put our own product in one of the existing categories and it narrows our search.

- Determine who the major players are in the industry. The report above will also list the major players who are on the radar screen of the analyst. Type in “review project management” or “reviews” or competition, etc. on Google and you will see a LOT of articles. Here is a sample:

- G2 Project Management Samples. Shows several applications. Note the “categories” that are being compared and the format. This will help you to determine your own category.

- Look for comparative software websites. In many cases, the category is so big that there are companies that compile competitive matrix information for project management software (or our own type) and then ask for contact information to access it for free. I would create a second e-mail address on Yahoo.com, etc., and use that.

- Consider Captera or G2. Following is one of those types of sites that is good for competitive analysis since they compile competitor’s information (look for more). Captera Project Management Samples

- Look for existing grids. I’ve included an attachment that has a grid from one of those types of companies (this one is for affiliate software—but the company that has this data may also have one for project management).

- Look for user-edited grids. Some allow you to pick your exact features, or category and produce a readymade matrix for you. Search for these types of sites and bookmarks so you can come back to them.

- Determine who your primary competitors are (those top 5 you run into the most) for your competitive analysis. If you have sold a product, you can select the top 5 you run into the most. If not, then you can consider from the analyst reports, from “toptenreview.com” sites and from Google Searches (although a company that may be good with SEO may not be one of your potential top competitors).

- STOP. Meet with the team to confirm you have the right competitors in the right segment before you move on.

- Now, start to create your own competitive matrix. We will create two versions (usually different tabs in the same spreadsheet). The first is for INTERNAL use only. It will show our strengths and weakness. It is just as critical to know where we are weak as strong–or we may go into a competitive product sales meeting with the Cisco Kid and find ourselves outgunned–our product may not be best for every segment and size and it may be better to “get out of Dodge” and target a segment we are better suited for.

- Use Excel Tabs to organize your data. When we have later finalized research, we can create a copy of our tab and turn off the areas we are weak in and that becomes our “public” version. It will be used by us on our website, with the press in our reviewer’s guide, in presentations and by our resellers.

PHASE TWO – Create your competitive matrix

You may be tempted, but do NOT jump to this section until you have completed the items above (it will slow you down if you do not do this leg work first).

- Categories. Start by listing the category types (PPM, APM, etc.) that you see in most of the reviews. You can also get the categories from your product manager, CTO, etc. If you compared CRM apps, these might include Pricing, SFA, Integration, Marketing Automation, or within Project Management: Collaboration, Resource Management, Project Management, Remote Access, Platforms, etc. Most product types will have standard categories (pricing, support, etc.) along with their own categories that are unique to their category. The features will fall under these categories. If you have to capture information, always use the TABS on the bottom of the spreadsheet.

- Features. Next, list the major features under each category that you see in most of the reviews. Also, go to the competitor’s websites to add their features–company by company. Each one might add some new features under each similar category (some may add new categories) so your matrix will look like a stairstep. You will usually go through all the competitors on a second pass to confirm if they have any features, you may have picked up from their competitors (these will often be harder to confirm (see documentation, FAQ, web searches, etc.).

- Important Tip. We don’t start by using just our own categorization since we may be later to the market and may not categorize the same (we may have to rename our features to conform to industry standards we weren’t aware of until we started). We would then map our feature names and categories to the common names that others have already defined.

- Fill in our information LAST (since it is easier for us to get our answers than competitors).

- Arrange the closest competitors next to us. The competitors we run into the most (or will) should be rearranged so they are closest to us.

- Add everything you find. Remember: If you find features from other software that we do not have, then add it to the spreadsheet–we may actually have it, or we may not (and it may or may not matter).

- Call LAST. The last thing you do (after hitting their website, reviews, FAQ, documentation, outside articles, and reviews) is call. Your Persona: You are a consultant (for now you are (how do you like your new title? )), or you work with a consultant (Chanimal) doing research on the latest updates. NEVER LIE. If they ask if you work for a competitor—say yes, the jig is up, and they’ll hang up. But most of the time they will not, so it is fair game.

- Remember–CALL LAST! You should only call if you only have a few hard-to-get questions left—don’t be lazy and call them too early since they might only give you 20 or so answers before they get curious and won’t help any further.

- Review. Once you have some substance, then don’t hesitate to review it with your direct manager or other members of your team to talk through it. Sometimes you’ll find some tips, or we can reduce the features saving you a lot of final leg work.

PHASE 3 – Hard-to-get competitive analysis information

When you cannot find the information, put a question mark ? in the grid (do not guess). Then try one of these additional steps:

- Google the name and the feature. One intern completed most of his part of a large matrix almost twice as fast as the other (very good) intern–by constantly Googling, rather than manually looking.

- Search by feature or source name. When using Google, use the name (product name) and search terms like “reviews, compare, matrix” etc. You can also use the company name with the terms, “features,” “guide,” “manual,” “datasheet,” etc. to see more detailed info. Don’t just look on the website. A Google search will check their forums, support, install, etc. sections.

- Hit their live chat. Go to their “live chat” and ask specific “pre-sales” questions.

- Call the companies–last (as mentioned previously). Start with sales. Next call support, etc. Tell them “I am an intern working on a project for an industry consultant who recommends products.” (if this applies)

- Ask their resellers. Call their resellers and ask for the same information. Use a similar dialogue.

- Look for any publications, white papers, or books. If books, get it at the local store (don’t wrinkle it), get your info and you may be able to return it–or get a pre-approved budget.

PHASE 4 – Formatting the competitive matrix

- Polish. When we are ALL done and have reviewed it and finalized it with the team, we’ll create another copy and call it Public. We’ll give it a formatting polish so we can use this publicly. We’ll make sure the data is consistent. We will also re-word any possible negatives or combine them with others to see if we can switch it to Yes.

- For example, “Uses External Email “might be NO. Change to, “Does not use external email” and you will get a YES. Convert all cells to YES or NO (do not put notes or qualifiers in the field). Change your feature descriptions if needed to produce a yes or no response. Hide all the NO’s for your product.

- Document version. Make sure you have the company name and the product name and the version or date on the top.

- Conditional Formatting. Use this feature (Excel) to convert all NO’s to RED (white text) and all YES to Blue (black text). Do not use Red/Green like a traffic light–you’ll get too many responses that it looks like a Christmas tree. Do NOT format too early or you often have to re-do the entire grid multiple times.

PHASE 5 – Distributing

- WARNING: NEVER send the spreadsheet matrix to anyone outside of the company/or not working with you as an Excel file–it also contains internal weaknesses (flaws) and is way too powerful for a competitor to have. Convert it to a PDF first. The easiest way to convert to a PDF that looks decent is the print to PDF but chose “custom postscript” as the paper size–then keep adjusting the size so it has equal borders.

- Outlets. I would post the matrix on the website (with some exceptions)–it puts all the competitors on defense, reduces the sales cycle (one-stop shop when they can validate their decision with your matrix), distributes to industry analyst, use it in your press kit reviewer’s guide (it helps set the criteria for the entire review), incorporate it in your sales PowerPoint, and leverage it to tighten your product positioning (Multiple reasons why someone would be a fool not to consider your product).

Q&A

- Should you publish your competitive analysis? Yes–the public version. It puts the competition in defense mode (they have to defend all their RED no’s). It also creates a stir–important to mix things up in a crowded space. It definitely helps prospects “see” your strengths and shortens the sale cycle (they feel like they have already done due diligence)

- Should I list my negatives? No. Do not even try to make your matrix look balanced—it is a lie. You and everyone else know it is biased (you created it right?). If they ask if you have any negatives reply, “Yes, but you’ll have to ask my wife and kids for them. This matrix is not designed to convince. It is designed to get us on the shortlist. If you value features, we have, that the alternatives are missing, then you would be a fool not to at least consider us.” This works well every time.

- Should I list an unknown competitor? Sometimes yes, sometimes no. If they are unknown, but you slaughter them in the matrix–it doesn’t matter if you mention them in your matrix, the prospect usually won’t bother looking (why when they are mainly “red”). You can also use, “alternative 1, 2” etc. If there is a major competitor that is well known–then I would definitely list them.

- Exceptions. If you are the undisputed market leader–you may need to know the information within the matrix, but you may not need to publish it except in the reviewer’s guides to press, analysts, etc. You won’t see MS Word publishing its matrix anymore (like they used to do against WordPerfect). You also will NEVER want to even acknowledge a minor competitor when you dominate your market space–it will raise them up to your level. MS Word would import WordPerfect files, but not Ami Pro (later Lotus WordPro) since they already won against their primary nemesis.

If you are a minor competitor–then you ALWAYS want to compare yourself to the top player(s) to raise yourself to their level (and they would be a fool to acknowledge you and counter (which would allow you to “draft” their brand equity) –if they do, then keep it going and try to turn it into a two-way “Rocky vs Apollo” fight. More details in the Strategy content.

Note: I prefer the blue (yes)/red (no) format (the IQ Reseller looks like a Christmas tree and some of the others are not as obvious)

Good Examples of Competitive Analysis and Matrix on Websites

- SugarSync. Shows how their product compares to DropBox and Google Docs. When you click on the specific competitor it also contains excellent reviews on the left side–helping ensure their product gets on your shortlist. Excellent competitive analysis.

- ConvergeHub. In a hyper-competitive CRM market, it is critical to put your competitor on defense. Here is a large grid that can parse according to what you want to see, plus the FULL grid as a PDF below.

- UGRU. An integrated CRM / Financial Planning application allows you to compare to a single competitor or the ENTIRE group.

- PostSharp. When you have a NEW category it is important to show how it compares to alternatives (in this case alternative dev tools). This page shows multiple comparisons and makes it much easier for prospects to see the differences.

Additional Competitive Analysis Resources

Here is a video about alternative competitive advantage. This is from a professor at BYU (Chanimal’s alma mater), but I like his animated video presentation format and his examples.

Hi-tech examples of his three strategies include:

- Operational Excellent (process). Dell systematizes everything and aims to move inventory into one side of their warehouse as unfinished goods (cases, motherboards, graphics cards, hard drives, etc.) and out the other side as complete PC’s packed in the truck ready to ship in less than four hours. This gives them a competitive advantage (not having “old” inventory for 3-4 months in the channel, when the latest has just dropped in price).

- Product Excellence. Motorola strives to have the best product from an engineering part. Within the three stools of strategy, they don’t often articulate (execute) the strength of their product–but they have pride in one of the best-engineered products.

- Customer Excellence. WordPerfect (may they rest in peace ;-) got immediate attention with their unparalleled customer support (even to this day) and they would even support an illegal copy of their software (and the user eventually switched to them when they got the cash). Their support teams were amazing (and large), but unfortunately, the company got taken out with a few product mistakes (supported OS2 first instead of Windows and were late to the market, plus the bundled Office conquered all).

Contact Info

Chanimal, Inc.

12109 Lake Stone Dr

Austin, TX 78738

512-263-9618

Click HERE to Email

Follow us on Facebook

NOTICE

I join a LOT of affiliate programs (connoisseur–like to see what they do), including Amazon, so there may be links throughout Chanimal.